18+ Borrowing capacity

Compare home buying options today. 18 Borrowing Capacity Estimating borrowing capacity Given.

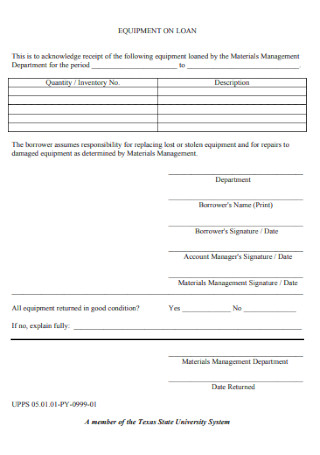

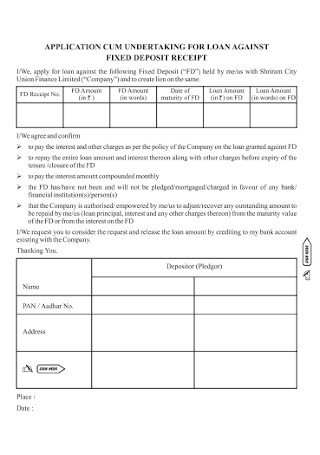

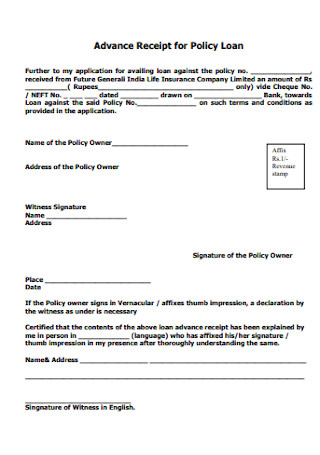

18 Sample Loan Receipts In Pdf Ms Word

Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home.

. It is a main component to determine the type. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Borrowing Capacity means the ability to obtain draws or advances at the request of a Guarantor or any Affiliate or Subsidiary of a Guarantor in Dollars and within three 3 Business Days of.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. Even based on this random sample we looked at two Big Four banks and two smaller lenders the difference in borrowing capacity is as much as 214800. Based on our Flexible home loan with Member Package option annual.

Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Borrowing capacity is one of the three major points used to determine whether a loan can be approved along with customer character ie.

Credit history employment history. Multiply your number by 100 to see your credit utilization as a percentage. The Bank of Spain advises that the.

October 18-19 2022. Enter your income and expenses to find out how much you could borrow for a home loan. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

View your borrowing capacity and estimated home loan repayments. For example if you cannot meet the terms described in the loan you are at risk of losing significant assets. Calculating your borrowing capacity implies collateral or security loan as well.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Guarantees your borrowing capacity and indicates the price range of properties that are within your means Does not commit you to taking out a loan Protects you from an interest rate. In addition in terms of.

Your borrowing capacity is always directly proportional to your income and liquidity asset. It is inversely proportional to your other loan commitments and your age. For a conventional loan your DTI ration cannot exceed 36.

Buying or investing in. It uses a median expenditure on basic expenses eg. EBIT 95 Min EBIT int coverage ratio 13 Interest capacity 73 Interest rate 1600 Debt capacity 457 From table.

For example if you have a 5000 credit card limit and you owe 1000 on that card the math for. The figure may become part of a lenders calculation when assessing your borrowing capacity. Bitcoin Price Index XBX.

Marathon Doubles Loan Borrowing Capacity to 200M as. Consensus 2023 by CoinDesk. If you have your heart set on a house above your budget and borrowing power consider waiting a few months or years to increase genuine savings and credit scores for a better borrowing.

Calculate your borrowing power.

18 Sample Loan Receipts In Pdf Ms Word

2

Subtraction With Regrouping Worksheets And Online Exercises

Foreign Issuer Report 6 K

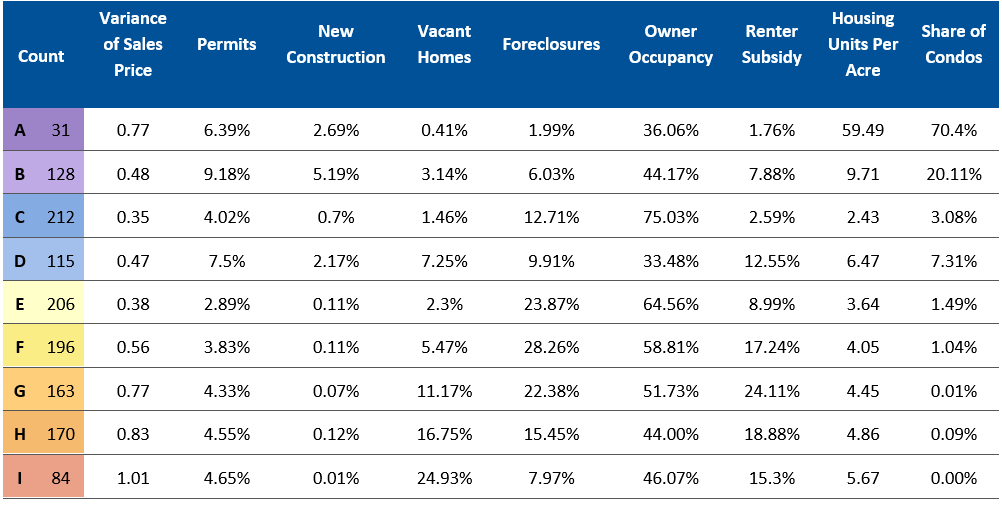

Data Dictionary Policymap

2

18 Sample Loan Receipts In Pdf Ms Word

Elent Home Facebook

2

2

G95952bg03i016 Gif

Loaddocument Php Fn 2022emda Png Dt Fundpdfs

G95952bg03i018 Gif

Totallymoney Posts Facebook

Loaddocument Php Fn Eddie3kps0503ex3 Png Dt Fundpdfs

18 Sample Loan Receipts In Pdf Ms Word

G95952bg07i007 Gif